| |

Solar

electricity (photovoltaics) in Flanders and Belgium

Section

I - Resumé of monthly VREG reports (status March 2, 2012)

Section II - New statistics with evolution of yearly

progression in PV capacity and number of installations (status: July

3, 2012)

Section III - Belgium market (status: May 2,

2012)

(updates

of monthly data postponed due to busy activities Polder PV, refer to the

July 3, 2012 data for good actual overview!)

Note:

Percentages mentioned are often rounded, and not always will add up to

exactly 100% in totals for a year.

On this webpage an

overview of development of photovoltaics in Flanders (Belgium) is made

in a few graphs, also highlighting the position in relation to other "renewable"

electricity options (Section I).

This page is an extension

of the webpage with the detailed monthly updates with many more graphs

highlighting the Flemish and Belgium PV-market. See the main

page.

Graph updated based

on March 2, 2012 month reports by VREG (Section I)

and the most recent Excel file "Evolutie van het aantal zonnepanelen

en hun vermogen" (misleading title translated as "Evolution

of the number of PV-modules and their capacity"), update published

by VREG on May 2, 2012 (Section II). Note that,

under normal conditions (synchronized reports), accumulated results between

the two datasets may differ slightly because of the period of sometimes

several days between their publication dates.

Section

I - Resumé of monthly VREG reports (status

March 2, 2012)

Fig.

1 - This graph shows the number of new PV-installations

per year registered with VREG able to claim green certificates for "renewable"

electricity. Since the number of PV-systems is so overwhelming with respect

to the few installations for the other "options", the latter

can not be seen on this scale. To view their contribution, refer to the

detail graph in Fig. 2.

Fig.

2 - Detail of Fig. 1 showing the contribution of all the

other "renewable" electricity options (PV-installation number

going completely off-scale in this graph). Beyond photovoltaics, the biggest

contributor with respect to "number of installations" appear

to have been "biogas rest", windpower and biomass installations

using materials from forestry and/or agriculture. Number of PV-installations

appear at the bottom of the yellow columns. Note that, starting with the

Feb. 1, 2012 report, a new option has been included (possibly better:

split-off), biogas (mainly) from agricultural sources (pink column segments).

Fig.

3 - Comparable to Fig. 1, but now showing the nominal

capacity of the accumulated "renewable electricity" generating

installations per year, in kWe. Options are grouped per year and are shown

with separate columns. For PV, MWe is the maximum AC-power of the inverters.

Even on this power capacity scale, PV-installations dominate all other

renewable options. Note that in 2011 total capacity has bypassed the volume

known for previous record year 2009 by far (already with 43%, and more

to come). In the January 1, 2012 report strangely a large 280 MWe installation

for the (previously unlisted!) year 1978 has been introduced, processing

biomass from agriculture and/or forestry (large green column at left).

In the same publication an installation in that category listed for 2005,

and with a capacity of 130 MWe, has been removed, also for unknown reasons.

For detail of a stacked graph, see Fig. 4.

Fig.

4. Stacked graph with all renewable electricity generating

options on top of each other, per year. The impact of photovoltaics is

impressive: it has most (accumulated) capacity of all options, although,

of course, it cannot generate as much since installations only produce

electricity in daylight hours. Preliminary accumulation for 2011 has now

reached 648 MWac for PV. Already far beyond the (preliminary) total new

capacity in 2010, and also beyond reach of the previous record year 2009

volume. Note also the old single large new installation for agriculture/forestry

biomass conversion at left (introduced in the Jan. 1, 2012 report). For

2012 only little new capacity has been registered with VREG (approximately

11 MWac).

Fig.

5 - In this graph the new capacity of photovoltaic installations

in Flanders is shown per year. In orange columns the older data (derived

from the last year report for 2010). In yellow columns the revised data

in the last month report. 2011 in a dashed column, 2012 in an open column

(preliminary results for Jan. - Feb. only). Note that data for some years

still can be adjusted, with largest changes expected for most recent years

(2009 and, in particular, 2010 and 2011). 2010 has shown considerably

less growth than record year 2009. 2011 has turned out to be a surprising

good year reaching a new record volume far beyond that of 2009...

Fig.

6 - Graph comparable to Fig. 5, but now with accumulation

of photovoltaic installation capacity at the end of each year (or, for

2011, as published in the last month report). With most recent data in

the monthly reports, accumulation has already reached a level of 1.549

MWac, which could result in a nominal DC capacity of app. 1.704 MWp. In

the summer of 2011, the magic "1 GWp barrier" has probably been

broken in Flanders. In Belgium as a whole, that could have happened in

early summer of that year (the other 2 markets, Walloon region and Brussels,

are (as yet) too small to have a serious contribution on top of the Flanders

data, see original statistics page

on Belgium).

Section

II - New statistics with evolution of yearly progression in PV capacity

and number of installations

(status: July 3, 2012)

This series of graphs

has been made using year data made available in a separate spreadsheet

(and/or pdf) from VREG with data per year and/or per quarter. The data

in this specific document can differ slightly

from the data that are presented in the mostly accompanying month reports

(graphs in Section I), since they are not always

published at exactly the same date. Hence: accumulation data etc. shown

in this section might deviate slightly from those extracted from the data

in the monthly reports. The "timing" of this specific spreadsheet

might be shortly before, or shortly after the monthly VREG report. For

the first results of 2012, see the final figure in the third

series.

Data processed with

Excel 2010.

First series:

evolution in the calendar year 2011 (adjustments up till update in July

3, 2012 VREG spreadsheet).

Fig.

7 - Updated results for the (whole) year 2011

(will be further adjusted in coming reports!). For previous versions:

May

2, 2012, April

1, 2012, March

1, 2012.

Number

of new PV-installations per period. VREG has divided the "population"

of new PV-installations into three big categories: installations up till

10 kW (AC), those with AC power larger than 10 kW, up till 250 kW, and,

finally, the largest category with AC power over 250 kW. In their 2011

overview, VREG has again divided the new capacity into three periods for

2011: First half year - January up till June (blue columns), third quarter

- July up till September (purple columns), and last quarter - October

up till December 2011 (green columns). Additions for the whole calendar

year are given in the final column group at far right in slightly deviating

colours.

The Y-axis

has a logarithmic scale. Note that in the third and fourth quarter of

2011 more installations have been registered by VREG (22.762 + 23.142

= 45.904) as in the first half year for the smallest category (35.839).

The larger categories, however, dropped off considerably with new installations

in the two final quarters in 2011: 603 (Q III + IV) instead of 844 (Q

I + II) for category 10 - 250 kW, and only 16 instead of 304 for the largest

category >250 kW. Ratio for total numbers (final column triplet) is

also higher (45.523) with respect to that for the first half year (36.987).

In the present update, the fourth quarter of 2011 saw a negligible volume

of 215 installations more than in the third quarter, an increase of less

than 1% (note that in the report at the start of February 2012, a difference

of 16% less installations were reported for the final quarter

related to the previous one).

Fig.

8 - Figure comparable to Fig. 7, but now results for the

three periods discriminated by VREG for the year 2011 have been stacked

on top of each other and given for all three categories as well as for

total for all installations (far right). For previous versions: May

2, 2012, April

1, 2012, March

1, 2012.

Y-axis

now is in normal mode to show the huge impact of the numbers of installations

within the smallest category (up till 10 kWac). Total installation number

in this VREG update has reached a volume of 83.510 for the year 2011 (March

1, 2012 report: 79.520, an increase of 5,0%). Shares for the three periods

shown are 44,3% (first half year), 27,8% (July up till September), and

28,0% (final quarter), respectively.

1.767

new installations (or: portions of larger systems) >10 kWac have been

reported sofar by VREG for the record year 2011. 320 (18%) of these installations

(or portions of big ones) had sizes over 250 kWac.

Fig.

9 - Figure comparable to Fig. 8, but now accumulated capacity

(MWac) has been shown. For previous versions: May

2, 2012, April

1, 2012, March

1, 2012.

This

gives a somewhat different picture, since the relative "few"

installations in the two bigger installation categories have a considerable

volume of capacity. 144,8 MWac new in 2011 for the category 10 - 250 kWac,

and an astonishing 263,7 MWac for the largest category > 250 kWac.

Please note, that in the March 1, 2012 report, that latter volume was

only 167,1 MWac, and that in the May 2, 2012 report, even a volume of

329,9 MWac has been published. Apparently, a considerable volume (66 MWac!)

has later been withdrawn by VREG for unknown reasons.

A volume

of 21% of newly reported capacity in 2011 has been added in Flanders in

the third quarter of that year. The fourth quarter has added 17% of total

volume. In combination with the high level of 411,8 MWac now accumulated

for the smallest category (up till 10 kWac), total new capacity added

in 2011 already has reached a volume of 820,2 MWac. Please

note that this has changed from 641,6 on March 1, via 815,5 on April 1,

and 845,3 MWac in the May 2, 2012 report. Hence, after strong increases

in monthly updates, some 30 MWac appears to have been "withdrawn"

from the 2011 records between the May 2 and July 3, 2012, reports.

If a

conversion factor of 1,1 is applied (DC capacity = AC capacity * 1,1),

new nominal STC power added in 2011 could already have reached an astonishing

level of 902 MWp, which is an exceptionally good result for a small region

like Flanders.

Please

note that, if the conversion factor has been applied in a reliable fashion,

this capacity outstrips the recently published total new capacity for

the whole of Belgium in 2011 in the Eur'ObservER report for that year

(publ. April 2012, see download

web page): market growth would have been only 775,5 MWp for Belgium

as a whole, according to this first Eur'ObservER estimate. A difference

of over 16% with the calculated volume for Flanders only based on most

recent VREG data for that year! Also the highly respected analyst bureau

of NPD Solarbuzz seems to have seriously underestimated total volume for

Belgium in 2011 (graph on their market

report web page). With the >100 MWp for Wallonia, total growth

for Belgium must have been a substantial >1 GWp in 2011 (slightly more

volume may be added by VREG in coming reports). Which could result in

Belgium becoming the fourth largest growth market in the European Union

in 2011, beyond Big Brother United Kingdom...

Strongly

depending on the realisation in India (as of yet not known, Photon's meta

analysis of October 2011, for example, suggested an installed capacity

of 500 MW for 2011, SolarPlaza suggested much

lower market volume for India in 2011), Flanders could ultimately

even have realised almost quadruple that volume of PV-installations in

2011 than in that booming new (strongly utility scale-driven) market in

the biggest democracy on earth (1,24 billion inhabitants mid 2011, PRB

data)...

Second

series: Evolution of PV-installations over the years.

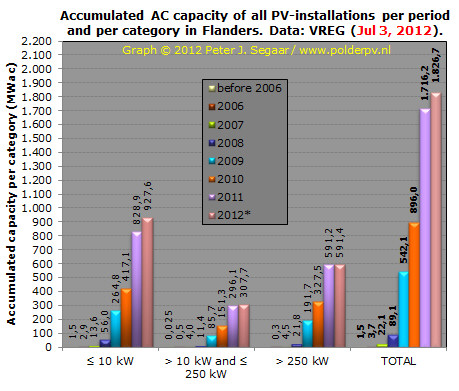

Fig.

10 - Evolution of accumulated PV-capacity (MWac) per category

and per year (2012 premature results for first half year). For previous

versions: May

2, 2012, April

1, 2012, March

1, 2012.

Progression

for the smallest category ("residential market") has been considerable

up till 2011 (a good sign of a "committed and mature" market,

with strong support of the population!). Also, volume of the largest market

segment (>250 kWac) has grown strongly, in particular as of 2009 (the

"boom" in 2011 has, however, been stalled in 2012 since green

certificate value for new installations has dwindled to an equivalent

of only € 0,09/kWh). The (revised) accumulated total volume of 89

MWac end of 2008 has grown very fast to a volume a factor 19,3 times larger,

reaching a highly impressive level of 1.716 MWac in 2011*,

and (preliminary results) 1.827 MWac in the first half of 2012. Note that

in the present year, only some growth has occurred in the smallest category.

The market segments >10 kWac have almost come to a stand-still. The

same may apply to the rest of the market, as the Flemish government has

decided that green certificates will not be worth more than €ct 9/kWh

for new installations as of August 1, 2012...

*

Note: on July 24, 2012, the "market

data" web page of branche organisation PV-Vlaanderen still depicted

ancient, end of January 2012 data for 2011, claiming only 1.476 MWac accumulated

capacity (see Fig. 10 for actual number), and a year growth of only 592

MWac for that year (for the latter, see Fig. 11; hence underestimating

14% and even 28% of volumes reported in the July 3, 2012 update).

Fig.

11 - New AC capacity per year and per category, stacked

columns. For previous versions: May

2, 2012, April

1, 2012, March

1, 2012.

2011

is - by far - the best year for Flanders, with already an incredible volume

of 820 MWac (in the March 1, 2012 report that used to be only 642 MWac)

new PV-capacity, of which an impressive portion of 412 MWac has been delivered

by small installations up till 10 kWac (50,2%), 145 MWac by installations

> 10 kWac and up till 250 kWac (17,7%), and 32,2% (264 MWac) by larger

installations. The impact of the smallest category is bigger than in the

years 2009 (previous record year, share 46,1%) and 2010 (share 42,9%).

The large volume of > 250 kWac installations in 2009 can be attributed

for a considerable part to the famous multi-site 40

MW project by Katoen Natie delivered end of that year. 2011 already

has a factor 1,8 times the new volume of previous record year 2009.

However,

thick dark clouds are already raining out on Flemish territory. The market

has dwindled in the first half year of 2012, and is expected to collapse

completely as of August (green certificate value for all new installations

max. 9 Eurocent/kWh). Up till now only 111 MWac has been reported by VREG

in 2012. Almost entirely consisting of smaller residential installations.

Flanders has had its heyday, and will enter a new Dark Age if the government

does not change their policy with respect to photovoltaics.

Fig.

12 - New number of installations (total only, number is

dominated by the smallest installation category by far, see Fig.

7) per year. Logarithmic Y-axis. For previous versions: May

2, 2012, April

1, 2012, March

1, 2012.

In most

years more installations were registered by VREG than in the previous

year, with the exception of 2010, and, to be expected, a collaps in 2012

(first preliminary half year results shown only). Total of 83.510 in 2011

signifies a volume a factor 198 bigger than the new volume registered

for the year 2006, and has been over a factor 2½ the volume realised

in 2010.

Fig.

13 - Accumulation of AC capacity of PV-installations in

Flanders up till 2012 (note: preliminary data for first half year of 2012);

graph with three different system size categories stacked per year column.

For previous versions: May

2, 2012, April

1, 2012, March

1, 2012.

End of

2011, Flanders had a minimum of 1.716 MWac (possibly in the order of 1.888

MWp nominal DC capacity), with contributions of 48,3% (smallest <=10

kWac), 17,2% ("medium"-sized) and 34,4% (largest installation

categories). Year-on-year (YOY) growth percentages (small-printed numbers/arrows)

have been staggering for Flanders, ranging from 145-508 percent/year up

till 2009, and still showing very strong growth in the periods 2009-2010

(65%) and 2010-2011 (92%). The final number for 2011 may still change

a bit, since full capacity additions for 2011 might still not be complete

(VREG updates "older" capacities in new reports). 2012 has been

a dramatic year for installations >10 kWac, and will become even darker

as the green certificate value for smaller installations will drop dramatically

from 23 to 9 Eurocent/kWh as of August 1, 2012 (see webpage

VREG with tariff changes; for Dutch

abstract of political background of these changes look here).

Status

on July 3, 2012 is that 1.827 MWac has been registered by VREG. This could

be an equivalent of slightly over 2 GWp (if DC capacity

is considered 1,1*AC capacity).

Fig.

14 - Graph comparable to the one shown in Fig. 13, but

now number of PV-installations accumulated end of each year is given.

Y-axis and numbers are given in thousands. For previous versions: May

2, 2012, April

1, 2012, March

1, 2012.

That

number is, of course, dominated by the "small" category up till

10 kWac (green column segments), that reached a preliminary high level

of 177.596 installations end of 2011, 97,7% of total volume of 181.734.

With data presently available, growth 2010-2011 has been a very strong

85,0% YOY. In the first half year of 2012, only the smallest category

grew notably, with total number of PV-installations reaching a record

level of 200.910. Note that the "Vlaamse Gewest"

(that is Flanders, without Brussels) had 6.251.983 inhabitants in 2010

(Wikipedia).

This means that, calculating with 196.670 smaller installations end of

June 2012 (max. size 10 kWac), on average one in 31 inhabitants "could

have" a PV-installation on its premises. A good start of a truly

decentralised energy (electricity) revolution.

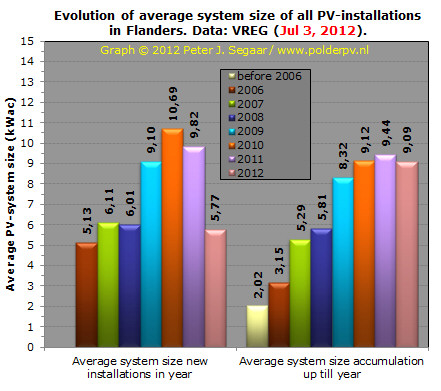

Fig.

15 - In this graph the evolution of the average PV-system

size in Flanders is given based upon the last available data published

by VREG. With preliminary results for the first half year of 2012.

In the

left column series average system size has been shown for the new PV-installations

in the (part of the) year depicted, in the right column series the average

system size for all accumulated installations end of the (part of the)

year has been shown. In the former series average size varies from year

to year, with a notable "new year installation record" of 10,7

kWac on average in 2010 (many large installations have been reported in

that year, increasing the system average). Due to strong degression of

the value of green certificates to be obtained by larger installations,

and the resulting collapse of that market, system average in 2012 has

strongly decreased (5,8 kWac in first half of the year): only the small

residential market segment is still growing (probably up till July), the

bigger two segments did not show any significant "activity".

The second

group shows stepwise increase of system average of ALL (accumulated) installations,

with a temporary "stall" in 2008. An important factor in the

decrease of growth in the average system size has been the strong growth

in the most important sub-market of all, the residential market, in record

year 2011 (see Fig. 10 and Fig.

12 for impact). Resulting in 9,4 kWac on average for all installations

end of 2011, which has receded to a level of 9,1 kWac in the first half

of 2012.

In conclusion,

since 2006 Flanders has reached very good results in the global records

for photovoltaics. It remains to be seen if there will be an attractive

business-case left for larger installation categories (as of Jan. 1, 2012,

the value for green certificates has dwindled to 9 Eurocent/kWh for installations

> 250 kWac), as module prices drop further. The same will apply to

the residential market segment, as of August 1, 2012.

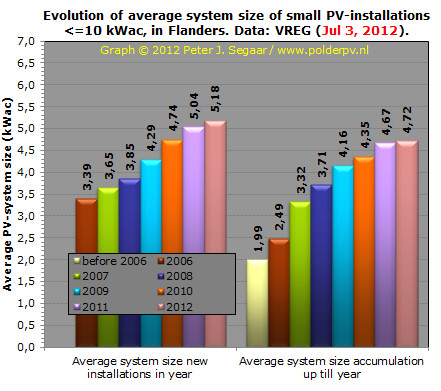

Fig.

16 - Graph comparable to that shown in Fig. 15, but now

only the residential market segment <= 10 kWac has been shown.

This clearly shows

the continuous upward trend in average system size newly installed on

private houses and smaller commercial dwellings. As of 2006, that average

has increased from 3,4 up till 5,2 kWac (possibly equivalent to DC generator

sizes of 3,7 up till 5,7 kWp). In the second half of the figure, average

system size of all <= 10 kWac installations also increased in course

of time, ending in the second half of 2012 with an average size of 4,7

kWac (app. 5,2 kWp). That is much higher than in neighbouring Netherlands,

where residential system size is often between 1 and 4 kWp, with many

installations sized 1-2 kWp or even smaller (actual status impossible

to pin down, since most installations in Netherlands are not registered

in a public register...).

Third

series: evolution in the calendar year 2012.

The February 6, 2012,

"global" update by VREG provided first results for 2012 and

have been updated in later monthly 2012 reports. In the final figure of

this section I present the first results for new capacity registered.

It is a rather modest volume, because the implementation of large installations

seems to have stalled completely. Further reports will have to be awaited

to see if the Flemish market really seems have come to a "stand-still"

such as branche organisation PV-Vlaanderen has suggested early in the

year. Volumes in the max. 10 kWac market segment have been growing - end

of June 2012 already 99 MWac has been registered for that category, which

could amount to a volume of app. 109 MWp. Neighbouring Netherlands realized

a volume of only

43 MWp in the whole of 2011, according to first (preliminary) data

by CBS.

Fig.

17 - First results for 2012 / first half year (preliminary

data): only 11,6 MWac additions for the smallest of the two "large"

categories, almost zilch for the category >250 kWac, and a

"relatively modest" volume of 98,7 MWac (March 1, 2012: 10,6

MWac) addition for the residential market segment (note that Y-axis is

in MWac!). It remains to be seen if these first data for 2012 would suggest

an under representation because of VREG administration lagging behind

in the new year, and/or that the Flemish PV market really has "collapsed"

(which is plausible). And if yes, if that "collaps" will endure

in a year that large volumes of very cheap PV-modules accumulate in the

harbours of Antwerp, Rotterdam, and Hamburg. For the residential market

(installations up till 10 kWac) volume is relatively low, and the big

question is if the first of August will be Doomsday for Flanders, or if

people still will buy PV-systems after the holiday season...

Section

III - Belgium market (status:

May 2, 2012, must be updated)

In this section the

latest known data for the three markets in Belgium, Flanders, Walloon

region, and Brussels, have been synthesized in two figures:

Fig.

18 - Preliminary results for year growth of PV market

in Belgium. Results for 2011 can change, in particular with respect to

the volume for Flanders, the most dominant market in this country. Numbers

for the Walloon region and for Brussels have been originally derived from

preliminary estimates by Apere, end of 2011. For Walloon region, preliminary

volume of approximately 107,4 MVA for PV has been assumed based on a CWaPE

update date-stamped February 29, 2012. For Brussels no new data for 2011

are known (regulatory body: BRUGEL). Status is that at least 954 MWac

has been added in Belgium in 2011, with more volume to be expected. This

could account to a new DC volume of app. 1.049 MWp.

Fig.

19 - As Fig. 18, but now the main figure shows accumulated

capacities at the end of the year and, for reference, the year growth

in the inset. Already, the small country Belgium, had accumulated 1.946

MWac of PV capacity, end of 2011 (1.740 MWac for Flanders). Which might

translate into a record breaking 2.141 MWp of nominal STC (DC) generator

capacity, the second "Gigawatt" (DC) certainly already broken.

An astonishing volume for a small country like Belgium.

With

later additions accumulated in the May 2, 2012 VREG report, total capacity

for Flanders now has already reached 1.797 MWac, with an expected DC volume

of approximately 1.977 MWp. Hence, in the coming report to appear around

June 1, 2012, it is highly likely that Flanders only will break its own

2 GWp barrier. A phenomenal achievement.

Fig.

20 - Update from the original figure added to Segaar's

Solarplaza / Solar Future Belgium article (published

March 6, 2012, with older VREG data from Feb. 6, 2012). In the present

version, the status of Flemish data published by VREG on May 2, 2012 has

been shown (more recent data for the other two sub markets not yet known,

Walloon region has been updated with preliminary CWaPE data for 2011).

Segmentation of the Flemish market in three categories for main figure

(capacity, MWac). Inset: accumulation end of each year for the three sub-markets.

Link

Statistics renewable

electricity in Flanders:

http://www.vreg.be/statistieken-groene-stroom

Webpage

made up for the first time May 18, 2011.

Updates: August 23, 2011 (VREG monthly report, publ. Aug. 1, 2011); October

11, 2011 (VREG Sep. 1, 2011 report), October 24, 2011 (VREG Oct. 1, 2011

report), November 23, 2011 (VREG Nov. 1, 2011 report), December 12, 2011

(VREG Dec. 1, 2011 report), January 9, 2012 (VREG separate statistics

file yearly evolution [addition of "Section

II"], Jan. 4, 2012), February 1, 2012 (VREG Jan. 1, 2012 report),

February 19, 2012 (VREG Feb. 1, 2012 month report and Feb. 6, 2012 Excel

file), March 15, 2012 (VREG Mar. 1, 2012 Excel file year data, addition

of updated segmentation graph Fig. 19), March 30, 2012 (VREG month report

March 2, 2012 >> section I updated), April 20, 2012 (VREG Apr. 1

pdf year data), May 5, 2012 (VREG May 2, 2012 Excel file), July 24, 2012

(VREG July 3, 2012 Excel file).

|